Contemporaries, Heinrich Hoerle, 1931–1932

Between the writings of Aristotle, Thomas Aquinas, and Adam Smith lie ages. Empires waxed and waned; various societal and governmental frameworks (monarchy, aristocracy, oligarchy, democracy) were tried and tested; and last but not least, the larger intellectual constellations of the times transformed dramatically (e.g., from the geocentric to the heliocentric worldview). Likewise, dramatic change occurred at the economic level. Aristotle observed the Hellenistic and pre-Hellenistic constitutions of Greek city-states and Middle Eastern empires; Thomas Aquinas analyzed the economies of European and mostly Christian monarchies of his time; and Adam Smith already saw bourgeois societies moving from hierarchical to functional governance structures and a budding global economy. Yet all the manifest transformations of the world of commerce notwithstanding, a common thread connects their economic philosophies: for each of these eminent thinkers, ethics was integral to economics.1

That is to say, for thousands of years, economic thinking was guided by moral reflections. Aristotle already made clear that a sheer pursuit of wealth (chrematistike) was never the proper goal of economics but merely a subordinate pursuit subservient to overarching ends. The proper ruling of private and public households (hence oikonomia, from the Greek: oikos/household and nomoi/rules, laws) was to be aimed at both the individual and the common good. Moral as well as political considerations were thus central to Aristotle’s understanding of economics.

The same holds true for the intellectual tradition that runs from Thomas Aquinas to the late scholastic schools of Salamanca and Coimbra as well as for various strands of Jewish and Islamic economic philosophy. Aristotle’s distinction between chrematistike and oikonomia continued to be constitutive for their variegated attempts at reconciling the logic of revenue seeking with the moral and religious frameworks of society. In particular, the idea of justice loomed large in medieval treatises on commerce. It was the bedrock on which to erect theoretical edifices comprising theories of money, price, wages, and the distribution as well as destination of goods.

For Aquinas and his followers, justice was not enough, however; economic agents were also beholden to complement its strictures by acts of charity. While certain aspects of said charity were left to individual discretion (and considered deserving of particular moral praise whenever properly enacted), others were widely seen to be of a different and more obligatory kind. Wherever justice was bound to fail (e.g., where its rules proved too general, thus requiring individual judgment and personal intuition to right a given situation), transcending its remit out of a spirit of charity was the expected social norm (whose neglect in turn led to moral reprobation). Far from leaving merchants off the moral hook to maximize profits as long as they merely observed the codified laws, Aquinas, and the scholastics in his vein, demanded that any and all commerce be conducted with a view to the Golden Rule and the common good.2

This twofold scheme of the responsibilities of business becomes tripartite in the works of Adam Smith. Far from being laissez-faire, as he is often still made out to be, Adam Smith advocated for the deregulation of mercantile systems of commerce but only within a concise framework of normative preconditions. His defense of the division of labor, the seeking of profits, and the opening of markets must be seen in the context of the ethical norms into which these postulates were embedded: for one, strict laws had to structure the market sphere, such that fraudulent and exploitative business practices were ruled out. Second, social mores had to be sound, so that people would derive from them proper role models of behavior. Third, individual responsibilities in proportion to one’s circles of personal concern (graduated up from the intimate and local level to ever-more abstract and ultimately global encounters) were to orient businesspersons in their transactions. With this tripartite framework in place, and only then, Smith proposed to entrust to free markets the allocation of goods and services according to the logic of commercial self-interest.3

In short, Aristotle, Thomas Aquinas, and Adam Smith all agreed that ethics was fundamental to economics: moral thinking provided the strategic goals of business and the economy; it instructed by which means to advance them and by which measures to assess micro- as well as macroeconomic success. That is to say, for more than two thousand years, the ethical evaluation of economic means and measures never appeared as an afterthought to economic analysis but provided its basic terms of reference.4 The contrast with today is patent.

Presently, ethics enters the pedagogy of economics—if at all—as an add-on to a curriculum that otherwise pretends to be value-free. Even at business schools, where students receive some training in business ethics, corporate social responsibility, and the like, such courses hardly represent the mainstream of their overall instruction—indeed, they typically run counter to it. Moral thinking is, in fact, often dismissed as unscientific, given that the epistemology, ontology, and methodology of economics have long since tracked positivistic lines. These days, therefore, ethics enters only “at the end,” as it were—that is, after the picture of economic reality has already been drawn up. Moral thinking in economics has shrunk to an attempt to curb particularly noxious forms of commercial activity. Little wonder, then, that many students of economics view ethics as either irrelevant—or even downright contrary—to the creation of prosperity. How did this come about?

Monument of the Three Unknown Prostheses, Heinrich Hoerle, 1930

When we look at the history behind the prevalent mechanistic paradigm of neoclassical economics, we see that corporations were portrayed as machines for profit maximization, subject to iron laws of competition and impervious to considerations of free and responsible moral agency. This history begins with a departure from the qualitative ends that in antiquity and the Middle Ages, and up until the early nineteenth century, oriented economic discourse—that is, a departure from concrete notions of subjective well-being and objective welfare and how they should be pursued. In the last 150 years, a drift occurred that brought about the contemporary self-imposed restriction to quantitative analysis in economics. In an effort to become just as “scientific” as their colleagues in the natural sciences, economists of the late nineteenth century consciously began to cut their discipline off from the social and political sciences, aligning themselves ever more with the methodological apparatus of physics and mathematics. In an attempt to analyze economic problems “purely” (i.e., without resorting to extrinsic values or doctrines), they increasingly looked to the mathematical models of physics (namely, mechanics) in search of a new paradigm.5

While mathematical mechanics gave the mechanistic paradigm its formal cause, utilitarianism contributed the material cause, in Aristotle’s terminology, with the effect that the entire discipline of economics was recast, to borrow a phrase from William Stanley Jevons (1835–1882), as a “mechanics of utility and self-interest.”6 The utilitarian contribution came initially from Jeremy Bentham (1748–1832). Because he was dissatisfied with the quarrels of metaphysicians over the salient norms of political and economic decisions, Bentham decided to subjectivize the realm of values hitherto taken to be objective. Instead of asking what would be right for all people due to human nature, Bentham pondered what benefited concrete individuals. The utilitarians who followed in his tracks weighted the utility of each person the same and ventured that one could achieve consensus on what was conducive to overall welfare if one measured what people actually appreciated instead of ranking what they ought to value. As a consequence, the notion of aggregate interest came to replace the idea of the common good. Motivated by the forces of pain and pleasure, human behavior seemed a natural phenomenon like any other, open to empirical observation. This view coincided, moreover, with a strong emphasis on self-interest as the main driver of human action. To make utility theory fit for mathematical treatment, Jevons changed Bentham’s definition of utility, which represented an (immaterial) increase in personal happiness, so it denoted “the abstract quality whereby an object serves our purpose, and becomes entitled to rank as a commodity.”7 With this transformation of utility into a function of (readily quantifiable) commodity consumption, Jevons sought to translate the vexing qualitative problem of societal utility optimization into the much simpler quantitative one of an aggregative maximization of commodity consumption. Later changes in the utility concept (e.g., Alfred Marshall’s move away from commodity consumption toward the willingness to pay for goods) did not alter the outcome: economics had begun to replace (moral) concern of “better” versus “worse” with a (technical) calculus of “more” versus “less.”

Jevons, moreover, eagerly awaited the advent of a full empirical disclosure of the human mind, “when the tender mechanisms of the brain will be traced out, and every thought reduced to the expenditure of a determinate weight of nitrogen and phosphorus.”8 Hence economics might soon become apodictic and predict human behavior accurately, without any recourse to empirical observations. Jevons’s ideal of an axiomatic economics, without need for social statistics and historical observation, was reinforced by an important move within Austrian economics toward the theory of marginal utility, spearheaded by the work of Carl Menger (1840–1921).

After Menger, Austrian economics no longer aimed to gauge the objective value of a good in and of itself, or in reference to its moral quality or social function, but from how given subjects valued an additional unit of the commodity in certain situations. To a thirsty man in a desert, (an additional unit of) water is more valuable than (an additional unit of) gold.9 Various technical differentiations in subsequent works aside, the gist behind this notion is clear enough: a move from substantial value estimates toward procedural assessments (expressed in prices), which reinforced the previous utilitarian turn from objective to subjective value theories. By discarding the notion of the objectivity of values, Menger believed, economics had a chance to become an exact science based on natural laws. Along with this came a retreat from metaphysical theories about free will, as Menger felt they threatened his epistemological program of describing human behavior with just as much precision as physical events. Postulating a freedom to alter the will that drives human behavior put into peril the very mechanical regularity of transactions upon which Menger rested the claim that economics was an exact science.10

What is the upshot of these methodological shifts? Before Adam Smith, economic theories operated with the notion of objective values not only to describe economic reality but also to prescribe it, with a view toward correcting aberrant subjective evaluations. For instance, by criticizing the miser for hoarding, antique, medieval, and classical economists rejected the value the miser subjectively ascribed to money as objectively too high. On the contrary, theories that read off the value of given commodities from what subjects are willing to pay for them do not establish any such critical distance to their objects. The prescriptive and counterfactual use of economic value theory hence collapses. In short, objective virtues were first turned into subjective values and then finally into neutral commodities. With the nonempirical dimension of values ostracized, economists committed themselves to what was left: determining the most intelligent use of scarce resources for given goals. This is the intended import of Lionel Robbins’s canonical formulation: “Economics is the science which studies human behavior as a relationship between ends and scarce means which have alternative uses.”11 To this day, countless economists shun any and all qualitative value judgments, insisting on defending their theories in merely quantitative terms.

Carrying over methods and metaphors from mechanics into economics creates a fundamental problem. Economics does not have inert, lifeless matter as its object of inquiry but lively human action, and to pretend otherwise leads to explanatory errors. Economic prediction is a particularly patent case in point. In economics, predictions are eminently self-influencing phenomena, which can be all too readily observed in stock and currency markets. In physics, an influence of the observer and/or the observation on the observed is the exception (occurring only in the subatomic realm of quantum physics), not the rule, whereas in economics, feedback loops between theory and practice are ubiquitous. Unlike physical systems, human beings form theories about their contexts and act not simply as they are driven by internal or external material causes but based upon the interpretations they make of the world they inhabit. Economic theory has an impact on economic practice.

Obfuscating the fact that free human beings are the factors behind all economic facts, a mechanistic economics projects the very rigidity of its method onto individuals and society, perceiving them, falsely, as subject to unalterable “economic laws.” Other than the laws of gravity, though, which do in fact apply no matter what we think about them, the structures of economic behavior are altered by our individual notions and ideals. Our economic freedom and our normative ideas about its responsible use play an eminent role in the economy, a role we neglect at our peril.

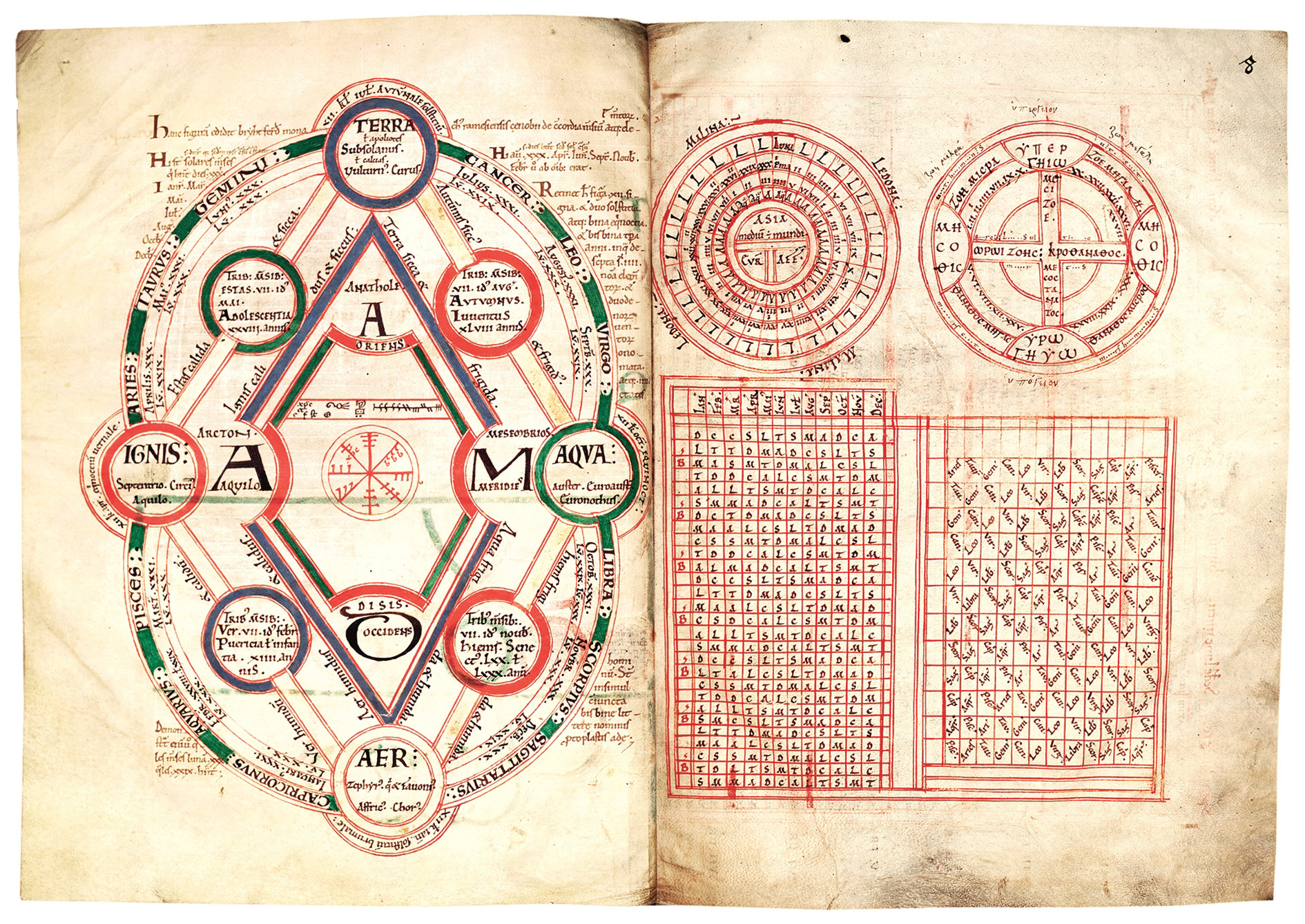

Byrhtferth’s Diagram; Computus Diagrams, c. 1102–1110

To give but one example: if you hold a deductively generated belief in mechanical market forces that will always restore a perfect equilibrium, you are likely to favor laissez-faire economic policies. John Bates Clark (1847–1938), for example, stated, “However stormy may be the ocean, there is an ideal level surface projecting itself through the waves, and the actual surface of the turbulent water fluctuates about it. There are, likewise, static standards with which, in the most turbulent markets, actual values, wages and interest tend to coincide.”12 On that assumption, we might prefer not to mess with these awesome natural forces that, in the long run, will put everything right anyhow. Yet thus we fall prey to our methodological biases. The market is, after all, not a natural but a social product, not a physical object but a cultural construct—which is what John Maynard Keynes had in mind when he quipped: “In the long run we are all dead. Economists set themselves too easy, too useless a task if in tempestuous seasons they can only tell us that when the storm is long past the ocean is flat again.”13

The methodological constructs of economic theory are hence no innocent devices. The less economists recognize how they are shaping the reality they observe, the less cautious (i.e., sensitive to the social consequences of their advice) they tend to be.14 For decades now, the positivistic posture of mechanistic economics, through its rejection of any and all qualitative standards, has promoted by default the pursuit of quantitative growth. The ideal of a value-free science has thus not emptied economics of values but rather brought the discipline under the sway of materialistic values.

This last point becomes most tangible in regard to the Homo economicus (economic man) of contemporary economic anthropology. For a century and a half now, economists have been defending their model of the Homo economicus—a forever-rational maximizer of self-interest—as an unavoidable basis for their methodological purposes. Observations of actual economic agents—especially recent research in behavioral economics, the cognitive sciences, and neuro-economics—have, however, documented time and again that our actual mental processes and economic activities rebut the logic of the Homo economicus model. Human decision-making happens, so to speak, both “below” the technical calculus the model presupposes (i.e., it is oftentimes based on irrational and/or nonrational impulses) and “above” it (e.g., driven by moral reasoning or aesthetic considerations superseding instrumental rationality).

Not only are the oft-lamented predictive failures of the Homo economicus model a dismal outcome of its inadequacy to capture the true complexity of human economic agency, but the pedagogical consequences of its near ubiquitous dissemination are even worse. Numerous empirical studies show how exposure to conventional economics instruction leads to a disintegration of the moral fiber of management students. In particular, it has been found that such students cheat more frequently on exams, are more prone to free-riding behavior, display less moral growth/development, are less willing to share, and are more likely to take advantage of others. These selfsame traits also were observed in managers who had received a standard economics education, in contrast with others who had not. The former displayed higher defection/opportunism rates, made smaller contributions to common goods or to philanthropic opportunities, accepted more bribes, were responsible for more layoffs, and esteemed power and hedonism more highly. Of course, the question was raised whether these alarming results were due to a self-selection effect among students. And while this, to a small degree, was indeed the case, almost all studies found that indoctrination effects were far more substantial than could have resulted from a self-selection bias.15

In short, students of business and economics differ from students of other disciplines both theoretically, in terms of their conception of the human being, and practically, in terms of the morality of their behavior. These effects run counter to the aspirations of many management professors, the majority of whom would prefer their teachings to have a pro-social effect. And this, eventually, inspired various management scholars to question the methodological foundations of their discipline.

Michael C. Jensen (b. 1939), one of the most renowned management scholars at present, may serve here as an exemplary case. Jensen’s model of the firm as a “nexus of contracts,” where self-interested principals and agents confront one another in opportunistic relationships—in due conformity with the Homo economicus model—was highly influential, leading many countries to implement incentive systems strictly geared to shareholder value maximization.16 Given that, his latest teachings may come as a surprise. Previously, Jensen brashly banned any and all values from management theory; however, in his writings after 2009, he has been busy promulgating an integrity theory, with the declared objective of helping students practice their personal values on the job with authenticity. Perhaps the most remarkable aspect of this change was Jensen’s stated motivation for developing his new theory. With a view to the moral failures that contributed to the economic crisis of 2008–2009, Jensen openly admitted that he himself had made a “personal contribution to the mess generated by out-of-integrity behavior,” not least through the very intellectual models he had previously disseminated.17

Even so, Jensen claims methodological consistency between his earlier stance (excluding any and all values from management pedagogy) and his later stance (which includes them) because, in his present view, both theories are strictly positivistic—that is, they purport to be solely descriptive and not at all normative. Jensen states he has merely moved from a less to a more realistic description of economic agency (i.e., from the fictional and reductionist Homo economicus perspective of conventional economics to a phenomenologically richer observation of how people truly are and act).

In matter of fact, however, Jensen’s pivot might imply much more than solely a shift in economic anthropology. It could rather be a first step toward a return from a mechanistic to a humanistic conception of management, for Jensen now aspires to make his students aware of their innermost being and aspirations. Students, he teaches now, should develop a management and leadership style in tune with their personal values. Many elements of this new approach resonate with what is currently en vogue in management pedagogics, notably the shift from a third-person to a first-person perspective, with a concomitant move of emphasis from knowing to being and doing. Jensen suggests his novel type of management learning can help students tap into hitherto closed-off resources. Reaching a deeper level of their personality, students could become more effective and persuasive in their efforts at managing themselves as well as others, since, as Jensen now stresses, values do indeed belong to the conditio humana, which is why they can, and should, be harnessed by managers.

In the introduction to “A Positive Theory of the Normative Virtues,” Jensen states his intention “to define positively what has thus far been dealt with as a solely normative issue, ultimately transforming the normative concepts of integrity, morality, ethics, and legality into positive phenomena.”18 As he sees it, previously prevailing notions of integrity, as defined by humans, have gotten us time and again into a “virtue mess,” where practical impact is both rare and random, due to a lack of theoretical clarity. Jensen rides to the rescue with positivistic concepts of morality and ethics, defining morality as “nothing more and nothing less than a society’s normative standards for right and wrong behavior, whatever they might be,” and ethics as “a given group’s normative standards for right and wrong behavior, whatever they might be.”19 Once, he suggests, we stop thinking normatively—or oriented at values—we shall no longer be pulled into different directions (i.e., by diverging moral ideals). Through “removing the aspect that defines integrity as a substance (‘sincerity,’ ‘uprightness’),” he promises, the virtue of integrity could be grasped “as a purely positive phenomenon, with no normative aspects whatsoever.”20 Once all moral overtones are expunged, integrity will be seen plain and simple as “the state of being whole, complete, unbroken, unimpaired, sound, perfect condition,” which, Jensen assures, is “empirically observable” and a “purely positive phenomenon, not a normative virtue concept.”21

In this view, the formerly moral domain of virtues such as integrity becomes amenable to scientific treatment. Normative morality, once it has been so shrunk, becomes measurable and thus available to functionalist analysis—and maximization efforts. Jensen’s current management pedagogics can thus proceed with the familiar tools of instrumentalist rationality. Since Jensen identifies integrity and authenticity as conditions for individual thriving as well as institutional effectiveness, he can lay out how students might well find it in their enlightened self-interest to obey certain (hitherto moral) councils, such as “keep your word” and “honor your word” as part and parcel of their overall endeavor of being successful managers. In this manner, Jensen believes, he has reconstructed on firm descriptive grounds what in the past were but elusive normative exhortations. In other words, Jensen’s new approach promises to accomplish, by a positivist methodology, what normative theories of virtues and values have sought but, according to him, forever failed to pinpoint.

On closer inspection, however, it appears that Jensen’s new approach, all positivistic posturing notwithstanding, might still be beholden to certain performative-pragmatic values. In order to translate one’s personal values into practice one arguably also has to realize certain (meta-)values that foster a certain corporate culture from which they are enacted. In a firm, personal values can only make a difference when others do not hinder their expression; they can only be effective when others actively support their enactment. If future managers were simply to pursue their idiosyncratic values, how could they orchestrate their behavior so concerted corporate efforts would result? How would they, in short, prevent a positivistic stance toward values in management education from resulting in a relativistic, and for that reason, contingent and ultimately incoherent corporate culture? Where anything goes, the value-driven agendas of some employees are bound to be at loggerheads with those of others, with the eventual effect of dissipating the very moral sap Jensen’s renewed pedagogy sets out to harvest. The same holds true for the relations corporations entertain with their external stakeholders, few of whom would take kindly to such inconsistency in corporate values and behaviors.

Would it instead not be better to integrate said diversity of personal values into a cohesive corporate strategy by prioritizing certain values over others? Does this outcome not already lie in the trajectory of a pedagogy rooted, as Jensen professes, in values such as integrity and authenticity? Yet this in turn might entail ending up with a normative stance, derived from moral prescriptions, because outside of entirely homogenous groups (i.e., almost anywhere in today’s multicultural age of globality), such an agreement on operative values rarely comes about by itself. Rather, it typically emerges as the result of deliberations and negotiations guided as well as guarded by normative arguments about the interpersonal validity of the respective values in question (i.e., by the exchange of normative perspectives). As a consequence, the normativity of moral stances cannot entirely be ignored when attempting to make certain values prevail over others. If, however, normative perspectives cannot altogether be shunned without substantially stunting Jensen’s overall endeavor, one might well conclude that he would do better to explicitly state the values that guide his hand rather than obfuscate them by speaking of a “value-free” approach.

In its assessment that future managers will be more effective and efficient when operating in harmony with their values, Jensen’s new theory is certainly on point. And this can be said pars pro toto for larger, ongoing developments in management pedagogy. But for Jensen in particular and the discipline in general, the crux of the matter appears to be the positivistic commitments inherited from the past. Like many of his colleagues, Jensen seems to think that any recourse to normativity must spell failure for the scientific aspirations of management pedagogy. Thus, he overtly denies the values that covertly guide his hand. And that leads us back to the beginning of this essay. Is it really the case that ethics corrupts the epistemic pretensions of economics? Were the ancient, medieval, and early modern economists all and sundry running a fool’s errand, without so much as an inkling about the errors of their ways?

I suspect that in their observations of economic affairs, Aristotle, Thomas Aquinas, and Adam Smith, when setting out from the value-infused conditio humana, were hewing much more closely to what economics as a discipline pretends to analyze than were their positivist counterparts. The more we receive empirical proof that the real Homo sapiens is far closer to the morally embedded zoon politikon (political animal) of bygone philosophical traditions than to the fictional entity called Homo economicus, the more reason we have also to revert back from a mechanistic to a humanistic approach in economics. As long as the respective values do not take a clandestine path into management pedagogics but instead are introduced openly to allow for their critical discussion and evaluation, academic standards are in no way threatened. Moreover, as this insertion of normative aspects stands to bring the discipline of economics closer to the reality it aspires to understand, such enhanced realism would also do much to improve the acuity and relevance of economic observations.

The best way to harness the moral energies of students and/or employees appears, therefore, to be to engage their hearts and minds in an overt discussion about the values that are to orchestrate their collective endeavors. Implementing moral ideals in corporate settings with authenticity and integrity—which Michael Jensen aspires to promote by way of his novel management theory—first requires the evaluation of the normative claims inherent to these ideals. It is true that this lies beyond the capacities of a merely positivist analysis, but that is not a reason to dismiss the normative dimension; if anything, it is a reason to dismiss the positivist pretensions of economics. In sum, if ethics is not to be ostracized from economic practice, it must no longer be externalized from economic theory and pedagogy.

Renovatio is free to read online, but you can support our work by buying the print edition or making a donation.

Browse and Buy